t-mobile taxes and fees texas

Generally speaking the Telecommunications Sales Tax Sales Tax Statutory Gross Receipts are all taxes on monies received for carrier services. Its hard to say if the charges would be exactly the same as tax fees can change.

Welcome To Montgomery County Texas

Texas Taxes and Fees.

. Net cost about 185-190mo. On average they will come to 096 128 and 100 respectively per month on a bill of about 30. Thats a good question.

14 rows It varies depending on your plan. State Universal Service Fund. Forums Texas Austin.

Calls Use GV to give us a home number in a 2nd location. Taxes and Government Fees. Today I got my Tmobile bill and noticed it was 7 more than it was last month.

Id suggest checking your own PDF bill online to see what shows up. T-MOBILE ONE PLUS 10 per lineper mo. Federal State and County Taxes.

This is a 46. Government Fees and Taxes. Federal Universal Service Fund.

So when a family of four signs up to pay 40 each with autopay for the unlimited T-Mobile ONE they actually pay just that for unlimited wireless service40 per. 313 rows A typical American household with four phones on a family share plan paying 100 per month for taxable wireless service can expect to pay about 270 per year in taxes fees and surchargesup from 260 in 2019. Total taxes fees for 5 lines is 1968 which is close to 20 of my monthly service fees after corporate discount.

GoogleVoice domestic call forwarding and cheap intl. Boat and Boat Motor. Discussion in T-Mobile started by THE W Nov 1 2012.

As an example on my bill for 5097 plan plus 599 internet and 499 msg in San Antonio TX my Taxes Fees and Surcharges are itemized as below for a total of 817. Announced at CES 2017 T-Mobile NASDAQ. State Sales Tax 306.

15 lineper month for other accounts. From Jan 2015 to Feb 2015 these fees increased my bill for one line by 515 388 was in the T-Mobile Fees Charges section and 127 was in the Government Taxes Fees section. We dont have taxes in Texas we have fees.

However T-Mobile also plans to charge taxes and fees for its Essentials plan on. 40 discount with T-Mobile ONE voice and 5 AutoPay discount. Rebate on 7 lines for low data use.

My taxes Fees per line is about 323 and another account level taxfee of 353. Income tax is paid by those with income. Includes 5 per line discount for qualifying 2 line account.

Nationally these impositions make up about 226 percent of the average billthe highest rate ever. Our Fees and taxes section has some additional info youll want to be aware of about any additional charges. A quick note on those tax numbers.

They never go away unless you do without. Four lines of Essentials works out to 120 before tax 30 a line but 150 including that average nationwide tax. Ad Switch to T-Mobile and get more 5G bars in more places.

The new T-Mobile Essentials plan offers a just the basics service for 60 per month. State and Local Tax. You can add the federal tax rate of 664 to the tax rate of your state to find out what percentage you are paying in.

This means that wireless customers are paying an average of 225 per year above and beyond the actual price of their mobile service. Texts emails and account memos officially notifying all impacted users of these changes should arrive soon and the same goes for those who are still subscribed to a tax-excluded plan in which case monthly fee increases will apparently range from 024 to. Tmobile BYOD taxes and fees.

Worry no more get peace of mind with T-Mobiles Price Lock guarantee. Cell Phone Taxes and Fees in Texas Austin. According to the consumer tax and spending think tank Tax Foundation average cell phone service fees and taxes have reached 186.

Automotive Oil Sales Fee. ADD 4G LTE DATA FOR YOUR TABLET AND OTHER DEVICES TABLETS 20 UNLIMITED with T-Mobile ONE voice 65 lineper month standalone. Regulatory Cost Recovery Charge.

T-Mobiles Essentials plan will cost 120 for four lines 30line while T-Mobile ONE goes for 160 40line. The federal tax rate on wireless service called the USF or Universal Service Fund is 664. TMUS has flipped the switch and gone all in with T-Mobile ONE.

I have the 100 unlimited talk City-Data Forum US. 51 rows Below is a list of state local taxes and fees on monthly cell phone service. T-Mobile One is 160 for four lines.

Thats right T-Mobile ONE now includes all monthly taxes surcharges and fees. However unlike the T-Mobile One plans taxes and. If you have more questions specifically about the T-Mobile Connect Prepaid plan please visit and post on.

On the 4 for 120 tax and fees 1675 So 13675 total 12 14 percent Including a state universal service fund fee. The company will also eliminate all plans except its T-Mobile One unlimited data plan on. 8 T-Mobile lines - Unlimited talk and text data.

T-Mobile will kill taxes fees on your phone bill. 9-1-1 Fees and Surcharge. Federal Universal Service Fund 062.

Sales Tax Messaging Email Templates Sales Tax Messages

How Can You Get Ein In Taxes Educational Technology Business Pitch Web Development Design

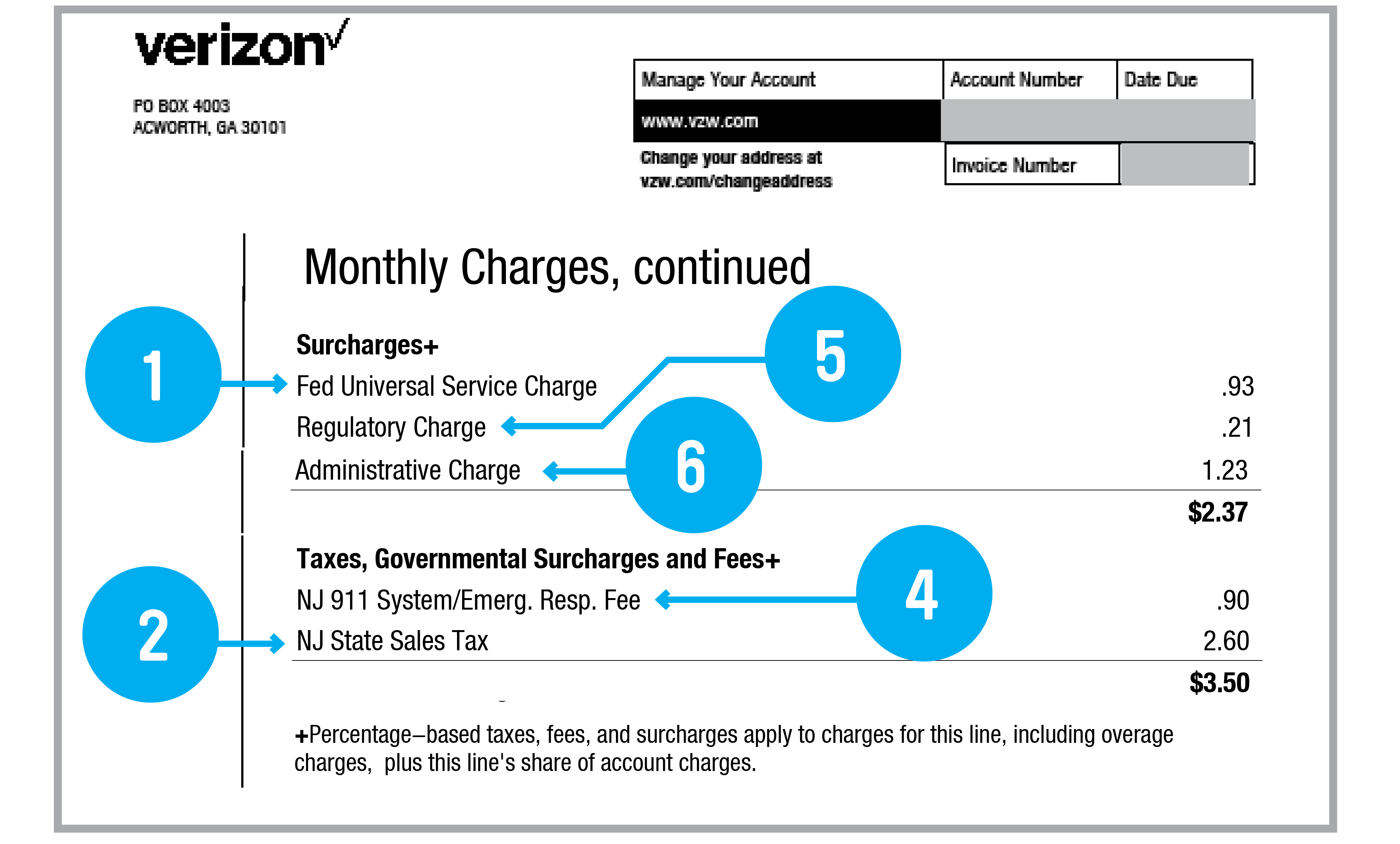

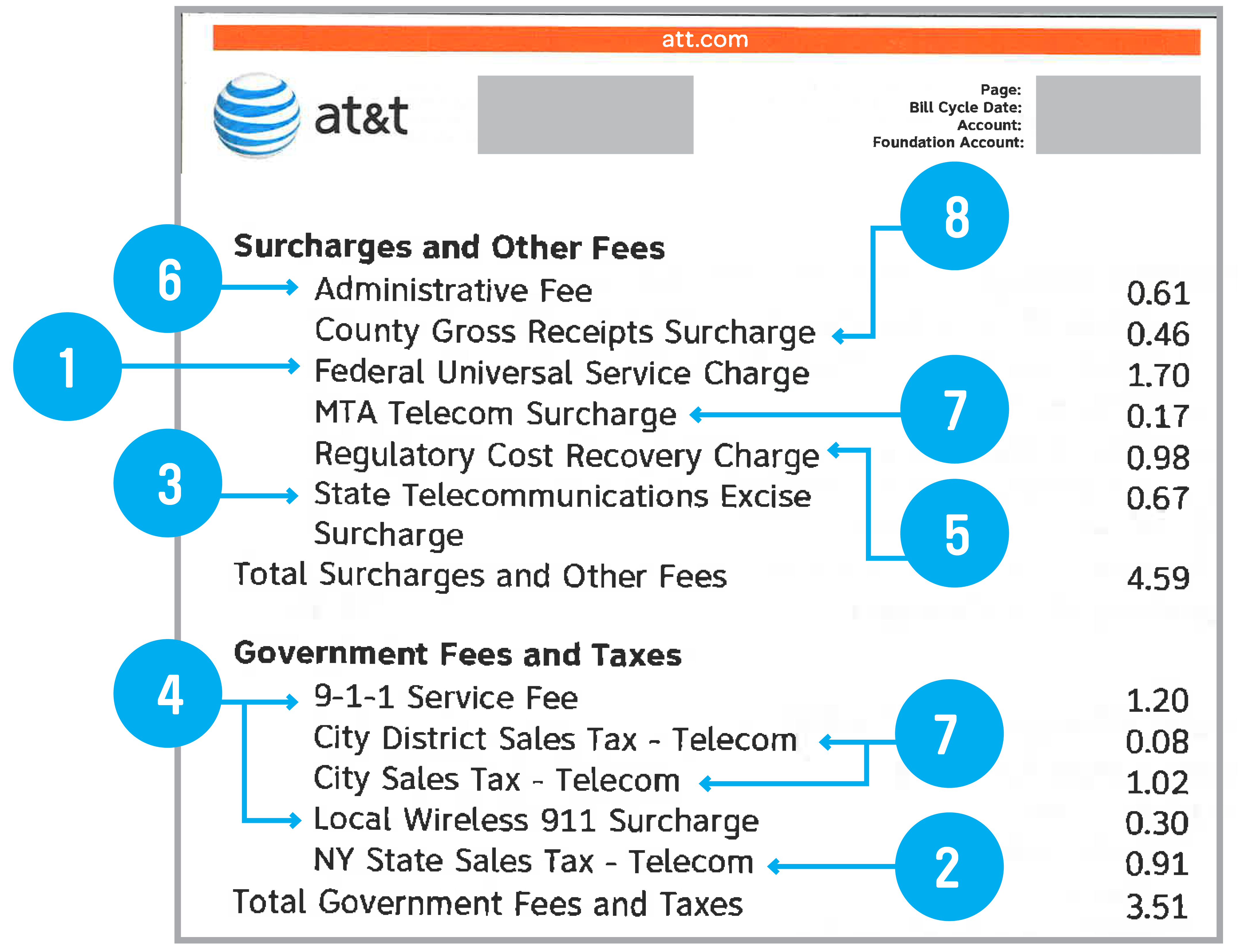

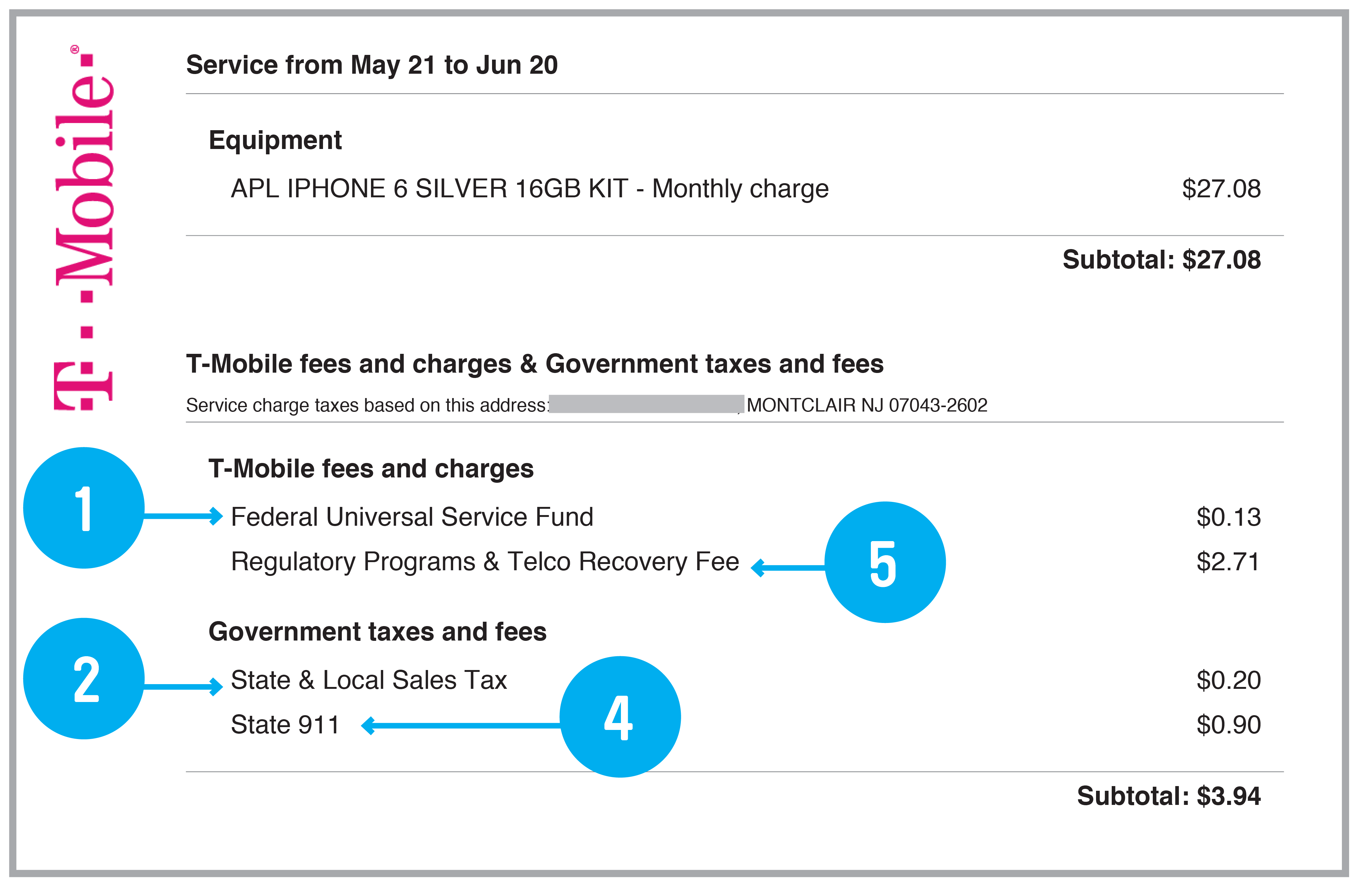

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

Spirit Of Texas Bank Online Banking Login Online Banking Banking Bank

Business Expense Tax Deductions Business Expense Business Tax Deductions Small Business Tax Deductions

Pin By Jon Schlussler On Taxes In 2021 Irs Learning Publication

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

I Did Not File My Taxes In 2018 Or 2019 Is It Too Late To File Taxes For A 1200 Stimulus Check Now Get Money Online How To Get Money Smart Money

Best Free Checking Accounts With No Overdraft Fees Checking Account Finance Saving Accounting

Iphone 7 Unlock Iphone Phones For Sale Iphone

Texas Sales Tax Small Business Guide Truic

Photo By Dzynpro Llc Business Business Tax Small Business Organization

Registration Fees Penalties And Tax Rates Texas

8 Sneaky Charges Hiding On Your Cell Phone Bill Money

Cable Package At T Document Store Cell Phone Bill Bill Template Phone Bill

Receipt S Receipts Receipt Personalized Items

Texas Tax Structure Public Administration Childhood Education Texas